We specialized in Alternative Investment

The Value of Alternative Investment

Alternative Investment assets enhance the capacity for diversification.

They provide versatility in the combination of risk factors.

They allow a better perspective of the risk quantitative analysis.

They are an essential tool in optimizing the Risk/Return binomial.

They provide asymmetry with the risks of investing in traditional assets, Bonds and Variable Income.

They act as strategic and tactical components by allocation and weighting in the composition of investment portfolios.

To fully understand the diversification power of Alternative Investment assets, it is critical to understand some aspects of their Classification.

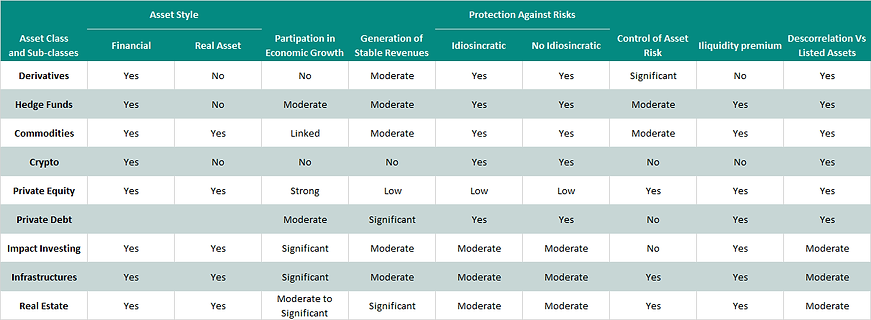

Table of Classification of Alternative Investment Assets according to criteria of Value Contribution and Risks.

Participation in Economic Growth: Based on the contribution and/or participation of these assets in the real economy.

Generation Stable Revenues: The ability of these assets to generate more or less stable returns.

Protection Against Risk: It is very important to understand for these asset classes the origin of the risk, which we classify as "idiosyncratic" and "non-idiosyncratic".

Control of Asset Risk: It is a second risk parameter that tells us about the capacity through the investment vehicle, depending on the asset, it is more or less significant.

Illiquidity Premium: Criteria that allows us to evaluate the additional premium for liquidity or liquidity risk.

Descorrelation Vs Listed Assets: Critical when seeking control of the Risk/Return binomial and critical parameter in diversification.

Our areas of expertise in Alternative Investment

Alternative Investment and Pension Funds

Since 2016 we have worked, researched and developed ideas for the inclusion and improvement of Alternative Investment asset allocation criteria in Spanish Pension Funds.

We use our experience of more than 20 years in Alternative Investments in monitoring the risks associated with the weight and allocation of Alternative assets.

We analyze the idiosyncratic value contribution of profitability in the inclusion of Alternative assets.

We analyze and investigate Alternative investment allocation in international Pension Funds and transfer our experience and knowledge to the Spanish Pension Fund market.

We study and analyze the quantitative importance of the inclusion of specific assets in the Alternative investment part of Pension Funds, such as the return added by investment in Renewable Energy Sectors and Companies.

Derivatives

We are experts in the design of tailor-made hedging strategy models.

We design and build systematic coverage models on Index Derivatives, Commodities and Cryptos.

We create models based on inputs from which we generate outputs that facilitate the generation of signals in the decision-making process.

We build market simulation models and create backtesting of strategies.

We work with our clients to design models, adapt them to their risk profiles and align ourselves with their targets.

Crypto Derivatives and Crypto Assets

We bring to the Crypto world our experience and knowledge of Derivatives.

We have developed a Crypto Options calculator that allows you to create simulations and market scenarios in crypto-currencies, simulate Volatility Spread conditions between expirations, Greek chart and Volatility surface.

We extend our Volatility expertise to develop systematic trading models.

We study and analyze the quantitative importance of the inclusion of this specific asset class in the Alternative Investment part of the Portfolio.